22+ Tax payroll calculator

Payroll tax and estate. This simple act allows us to keep these tools free for you to use and focus our team on new.

Form 8621 Calculator Pay As You Go Form 8621 Calculator

PaymentEvolution provides simple fast and free payroll calculator and payroll deductions online calculator for accountants and small businesses across Canada.

. If you are looking for a feature which isnt available contact us and we will add your requirements to this free payroll calculation tool. In the 2022 tax year the federal flat tax rate for bonuses is 22. Ad Heartland Makes Payroll Easy with Margin-Friendly Pricing for Your Business.

Individuals can use this tax calculator to determine their. In order to properly account for the FICA payroll tax reduction and if applicable the recapture tax it is necessary for users to associate the portions of their W-2 income in the proper months that it was earned. Is it time for a smaller office with more staff.

Edmonton Oilers salary cap contracts roster draft picks salary cap space stats salary cap projections and daily cap tracking. Wage Bracket Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Later. The 202021 tax calculator provides a full payroll salary and tax calculations for the 202021 tax year including employers NIC payments P60 analysis Salary Sacrifice Pension calculations and more.

GST - the Goods and Services Tax is an indirect tax in India. Pre-Tax WithholdingsSuch as 401k or FSA accounts that are exempt from payroll tax. Choose Your Payroll Tools from the Premier Resource for Businesses.

We wont go into all the. Ad Designed for small business ezPaycheck is easy-to-use and flexible. Almost all employers automatically withhold taxes from their employees paychecks independent contractors and self-employed individuals need to submit quarterly or yearly tax payments independently as it is mandatory by law.

Rather the government divides your taxable income into brackets and taxes each bracket of. The 202122 tax calculator provides a full payroll salary and tax calculations for the 202122 tax year including employers NIC payments P60 analysis Salary Sacrifice Pension calculations and more. View a full payroll tax calendar for any tax year including 20222023 - select a tax year and see all dates weeks and months for the tax year.

The salary sacrifice calculator for 202223 Monthly Tax Calculations. Tables A - Pay adjustment tables has been added to the collection. The payment periods are show in the top columns of the salary table and the various tax and payroll deductions are illustrated in each row.

Adjusted Federal Income Tax. Supplemental tax rate. As always adjust your payroll tax withholding to reflect the 2022 changes to income tax withholding tables.

To find an estimated amount on a tax return instead please use our Income Tax Calculator. FICA Part 1 Social Security Tax. Including federal and state tax rates withholding forms and payroll tools.

Are You Ready for a Self-managed Superannuation Fund. And the state tax rate for employee bonuses varies across the country so make sure to select your state from the calculators drop-down menu to calculate state tax. Taxpayers are not charged a single rate on all of their taxable income.

Tax code is used by the employers and pension providers to calculate how much Income Tax a certain person must pay. Version 105 12222001 final California tax rates installed child tax credit amounted updated in all spreadsheets. Enter your filing status income deductions and credits and we will estimate your total taxes.

Salary Calculation for 95k. Effective payroll management solutions start with Ayers. Personal Tax Credits Return and the form TD1X Commission Income and Expenses for Payroll Tax Deductions.

Completed overhauled for 2019-19 tax year our new salary and tax calculator is built to support all your salary and payroll audit needs. FICA Part 2 Medicare Tax. Budget 2022-23 This calculator has been updated to use 2022-23 Budget however figures may change in the October 22 Budget update.

Ad Get the Payroll Tools your competitors are already using - Start Now. On top of that 22 youll need to deduct the typical Social Security and Medicare taxes FICA taxes. North Dakota State Income Tax.

GST is levied on the sale of goods and services in the country. Here When it Matters Most. Income tax in Australia is imposed by the federal government on the taxable income of individuals and corporations.

By law some payroll taxes are the responsibility of the employee and others fall on the employer but almost all economists agree that the true economic incidence of a payroll tax is unaffected by this distinction and falls. Please note this calculator is for the 2022 tax year which is due in April 17 2023. Rates allowances and duties have been updated for the tax year 2015 to 2016.

With its origin it has replaced many other indirect taxes in India such as VAT CST central excise duty service tax and so on. The IRS also provides a federal tax calculator for withholding each year. These rates are 10 12 22 24 32 35 37.

GST is collected at the point of consumption and not at the point of origin unlike other. Federal Income TaxThe biggest tax of them all which can range from 0 all the way to 37. 1040 Tax Estimation Calculator for 2022 Taxes.

75 basic 325 higher and 381 additional. For verifying your payroll deductions you can use the Payroll Deductions Online Calculator PDOC. State governments have not imposed income taxes since World War IIOn individuals income tax is levied at progressive rates and at one of two rates for corporationsThe income of partnerships and trusts is not taxed directly but is taxed on its.

See the table below. 13 22 or any other number of pay periods for the year. Customized Payroll Solutions to Suit Your Needs.

Payroll taxes are taxes imposed on employers or employees and are usually calculated as a percentage of the salaries that employers pay their employees. You can include your income Capital Gains Overseas Pensions Donations to charity and allowances for family members. If you compute payroll manually your employee has submitted a Form W-4 for 2020 or later and you prefer to use the Wage Bracket method use the worksheet below and the Wage Bracket Method tables that follow to figure federal income tax withholding.

Your free and reliable payroll and tax resource. Current Dividend Tax Bands. 22 April 2016.

EzPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More. Use this calculator to quickly estimate how much tax you will need to pay on your income. Deduct these withholdings in order to come up with taxable income.

There are tax brackets and earnings thresholds that determine how much tax a certain person is to pay. This one also goes on payslips but has a different purpose. The dividend tax rates for 202122 tax year are.

This calculator is always up to date and conforms to official Australian Tax Office rates and formulas. The Tax Calculator allows. Calculate your payroll tax quickly and easily using this payroll tax calculator from Ayers Group.

Different tax rates are applied to different employees. If you do have other income streams such as rental or investment income let your accountant know and they should be able to provide a personalised tax illustration. If you use online payroll software.

Payroll Deductions Online Calculator. For information on 2022 provincial or. Based on your projected tax withholding for the year we can also estimate your tax refund or amount you may owe the IRS.

We provide all of these tax salary and payroll calculators free of charge all we ask is that if you have time you kindly leave us a rating andor share on social media. The Spanish Income Tax Calculator is designed for individuals living in Spain and filing their tax return in Spain who wish to calculate their salary and income tax deductions for the 2022 Tax Assessment year 1 st January 2022 - 31 st December 2022.

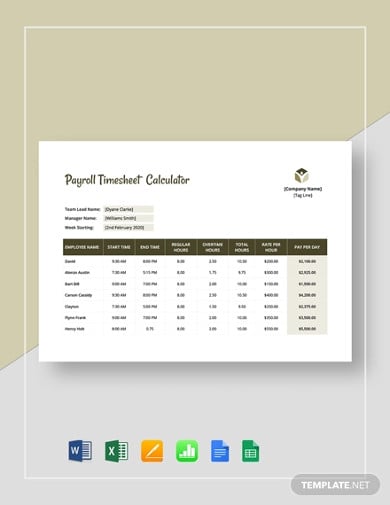

Free 22 Payroll Templates In Excel

Free 22 Payroll Templates In Excel

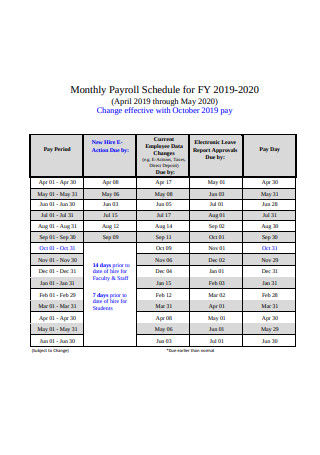

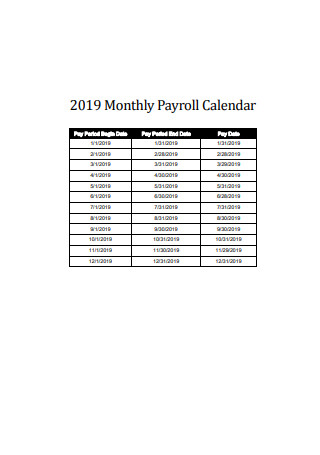

22 Sample Monthly Payrolls In Pdf Ms Word Excel

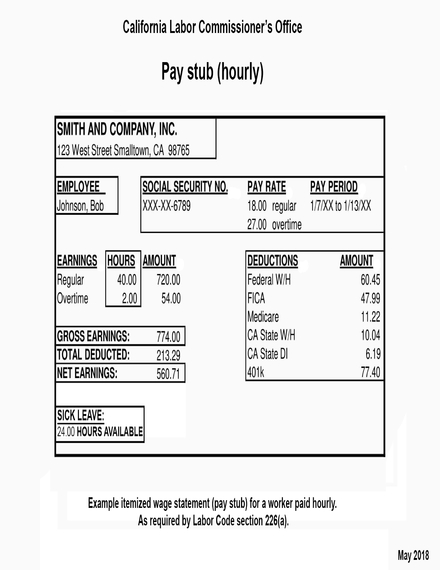

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Calculator

Free 22 Payroll Templates In Excel

Form 8621 Calculator Pay As You Go Form 8621 Calculator

Form 8621 Calculator Pay As You Go Form 8621 Calculator

Form 8621 Calculator Do It Yourself Form 8621 Calculator

22 Sample Monthly Payrolls In Pdf Ms Word Excel

14 Pay Stub Sheet Templates Free Premium Templates

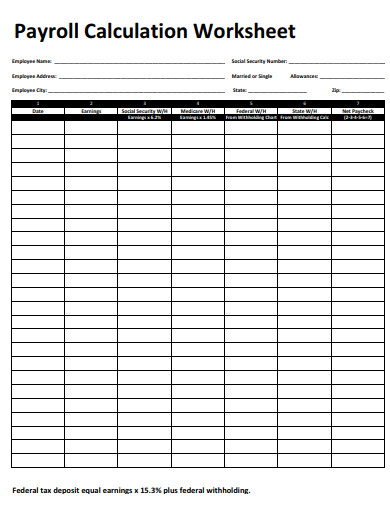

11 Payroll Worksheet Templates In Google Docs Google Sheets Xls Pages Numbers Pdf Word Free Premium Templates

Free 22 Payroll Templates In Excel

Payroll Sheet Templates 10 Free Samples Examples Format Download Free Premium Templates

Free 22 Payroll Templates In Excel

Payroll Sheet Templates 10 Free Samples Examples Format Download Free Premium Templates

Free 22 Payroll Templates In Excel

Free 22 Payroll Templates In Excel